The Powerful Strategy You Need To Build Wealth

Infinite Banking

In 2003 I was close to finishing my undergraduate degree when I become aware of a concept. It was how to become your own banker using life insurance. Although it was intriguing and was always in the back of my mind, I was setting out to make a living in the stock market.

Fast-forward several years to 2012. I had spent the last 8 years in the markets and the most recent 2-3 analyzing what Wall Street sold. Compared that to what consumers received revealed a large gap. At this time, I rediscovered The Infinite Banking Concept®. Looking at it from both sides of the coin, I discovered the true power behind the strategy.

If you’ve ever heard of the Infinite Banking Concept, then you’re reading this article either as a skeptic or a fan. This concept is also referred to as IBC, Cashflow Banking, 7702j and a Wealth Maximization Account. This post will discuss the many benefits of Infinite Banking. You can then consider the advantages of breaking away from the typical financial advice that is so prevalent in our society.

What is Infinite Banking?

The Infinite Banking Concept ® term was coined by Nelson Nash who wrote a book in the 1980s titled “Becoming Your Own Banker”. He discusses a strategy using a whole life insurance policy as a savings vehicle rather than a traditional savings account at a bank. With Infinite Banking, you have a vehicle to grow your money, and also a vehicle to transfer wealth to future generations. This type of approach takes a long-term viewpoint.

The overarching concept of Infinite Banking is to buy a high cash value, dividend-paying, whole life insurance policy from a mutual life insurance company. You can buy this on yourself or someone in which you have an insurable interest. You then over-fund that policy to its maximum potential with premium payments. You also want to stay within IRS guidelines. If not, the policy will become a modified endowment contract.

One of the benefits of funding a policy is a part of each premium payment converts to cash value. Think of cash value as your account balance, it’s the amount of cash you have available inside your policy. Having cash value inside your whole life insurance gives you liquidity. This liquidity allows you to take a loan from the life insurance company and uses your cash value as collateral.

Since this loan is 100% collateralized you have a lot of flexibility. The insurance company has a simple application process. They don’t look at your debt to income ratio or check your credit score. They’re simply going to determine if you have enough cash value to cover the loan you’re requesting. If the cash value is available, you get the loan, if not, you don’t; it’s that simple.

You can then do whatever you want with that loan. Again, since the loan is already collateralized with your cash value, the mutual life insurance company doesn’t care what you’re using the money for. They allow you to set the terms to which you pay it back too. You can make monthly, quarterly, yearly payments or pay it all back at once. Whatever works best for your situation.

With your policy capitalized and the ability to easily take loans your only job now is to start acting like a banker. You can now begin to make either life purchases or investment purchases. The key to building wealth is to be an honest banker with yourself and pay yourself back with interest. Why pay yourself back with interest? Because this is a banking system and you should put a price tag on any money lent out. It helps your banking system grow. This will allow you to make larger and larger investments in the future.

Borrowing your own money and paying yourself back with interest is an easy concept to grasp. You can do that with a regular savings account or even a show box if you’d like. Although, there is tremendous value in utilizing a high cash value, dividend-paying, whole life insurance policy instead.

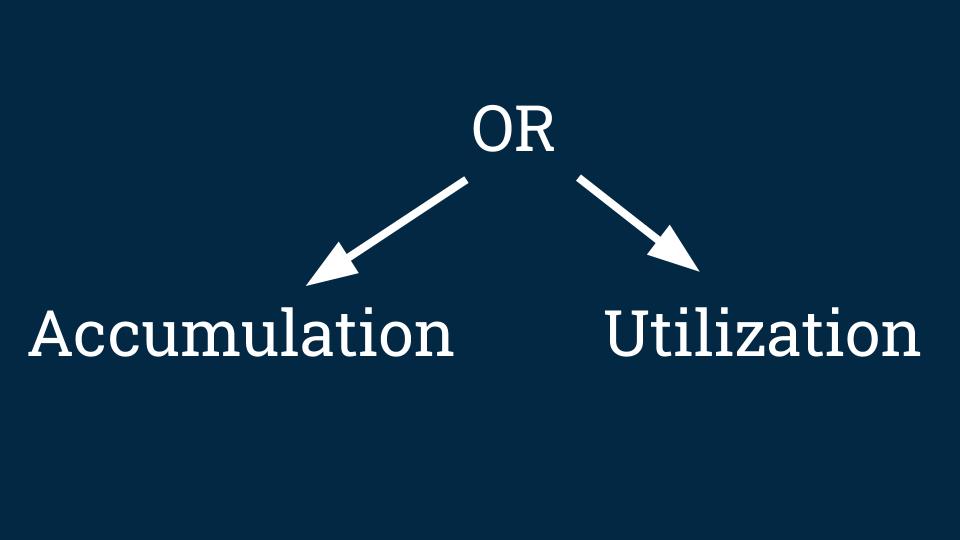

Accumulations vs Utilization

One of the benefits is accumulation versus utilization. Every dollar you make or every dollar that goes through your hands you have a choice on what you do with that money. You can either choose to place it somewhere in which your goal is to accumulate dollars so those dollars will grow. You then have the chance to acquire more dollars.

The common types of accounts out there for this are a long-term savings account, a brokerage account and certificates of deposits (CD’s). Qualified retirement plans such as the 401(k), IRA, 403(b), TSA, etc. also fall in this category. These accounts are designed for you to deposit your money into them, let that money sit and potentially grow.

Or you can choose to place that money into an account that will allow you to utilize it or spend it. The most common types of accounts here are a short-term savings account, a checking account, cash, lines of credit, credit cards, etc. Any account that you choose to hold your money for a brief period of time is a utilization vehicle.

The problem with each of the scenarios above is that you must choose one OR the other, you cannot have both. If your money is in a 401(k), it has the potential to grow but you can’t use it for anything; it’s locked up. In reality, the 401(k) is one of the greatest scams in America but that’s a discussion for another day. The opposite is also true. If your money is sitting in a checking account it does not have the opportunity to grow because you plan to spend it.

So why does any of this matter? It all has to do with compound interest.

Compound Interest

One of the best ways to build wealth over time is to take advantage of compound interest. In order for compound interest to work, two things need to take place. The first is time and the second is consistency. The only way that money compounds is if there is a consistent return over an extended period of time. This allows the interest you’re earning on your money to also begin earning interest.

If at any time you interrupt the compound you drastically reduce your money’s growth. Over an extended period of time, this has a dramatic effect. This is one of the reasons most people hit retirement not having enough money to live on. At some point in their life, they pulled money out of their savings accounts and eliminated the chance for that money to continue to grow. Then, life happens again, and the process repeats over and over like a dog chasing its tail. Fast forward to retirement. The pool of money they thought or hoped they would have is far less than what they anticipated. Leaving themselves in a bind.

Spending Habits

Then there are spending habits and typically there are two ways that people spend money. The first way is they’ll open an account and start depositing money into it. Over time, they’ll save up, save up, save up. Then at a certain point, they spend the money and take their account back down to zero. Then they’ll save up, save up, save up, make another purchase and take their account back down to zero. This process repeats over and over which isn’t necessarily bad but fast forward 5, 10, 20 years and where is their account balance? It’s at zero, they haven’t gotten ahead.

The second way money is spent is the complete opposite. Rather than having the patience to save money over time. People will spend it first and then make payments to pay it back. Once the money is paid back, they find something else to buy. They keep repeating the process by spending money and making payments over time to pay it back. Again, fast forward 5, 10, 20 years and where is their savings account balance? It’s at zero, they haven’t gotten ahead either. In fact, they’re further behind because of all the interest they’ve paid over the years.

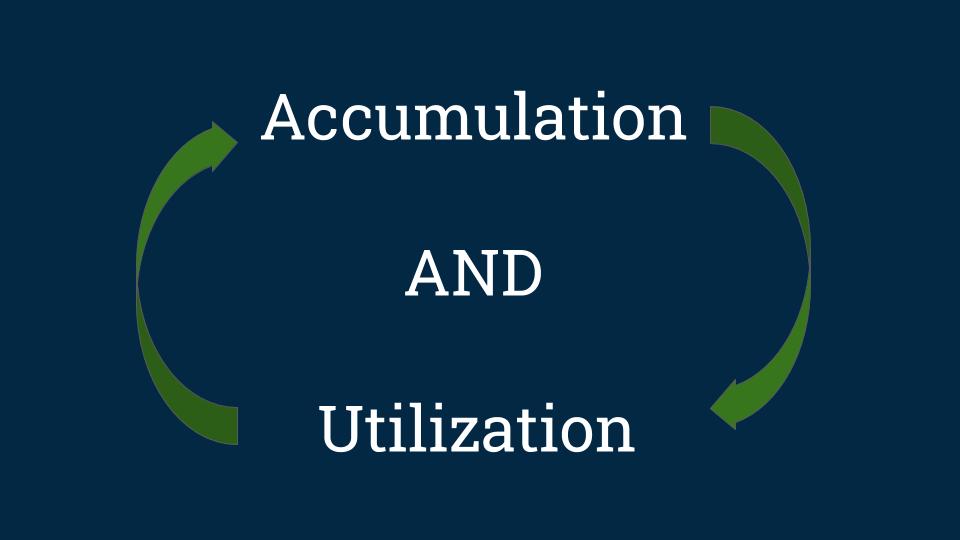

The “AND” Asset

To solve the problem of choosing whether you place a dollar in an accumulation account or a utilization account, we look to a high cash value, dividend-paying, whole life insurance policy. Due to the unique nature of whole life insurance. Rather than choosing to accumulate or utilize your money, you can choose to do both. This is due to the policy’s loan provision. Using the Infinite Banking Concept®, you can accumulate money “AND” Utilize it at the same time.

As stated before. When you pay premiums into a whole life insurance policy part of your premium becomes cash value. The cash value is important for several reasons. One of those reasons is cash value is the part of your life insurance policy that will grow and compound over time. This is due to the guaranteed interest as well as the non-guaranteed dividends you get. This cash value will continue to grow over time as long as your policy is in force. This means you pay your premiums and you do not surrender the policy.

The other beautiful aspect of your cash value is you also have the advantage of taking a policy loan. You can do this at any time up to the amount of your cash value. Policy loans are easy to get. There is no credit check. There is no background check. There aren’t even questions about what you’re doing with the money or how you’re going to pay it back. When you request a policy loan the insurance company looks to determine if you have enough cash value. If there is, you’ll have the money in a few short days. If there is not, you won’t, simple as that.

Here is why the policy becomes the “AND” asset. Your cash value is sitting inside your policy growing and compounding over time. When you take a policy loan, you’re not actually withdrawing the cash value from your policy. You’re using the cash value as collateral. Therefore, by placing money inside your whole life insurance policy you are accumulating or growing your money. The cash value will also continue to earn interest and dividends on the entire balance. This happens even when you have an outstanding loan with the insurance company. By redirecting your money into a policy first, you are able to accumulate (save) “AND” utilize (use) the money simultaneously. This happens without disrupting the compound curve.

The Banking System

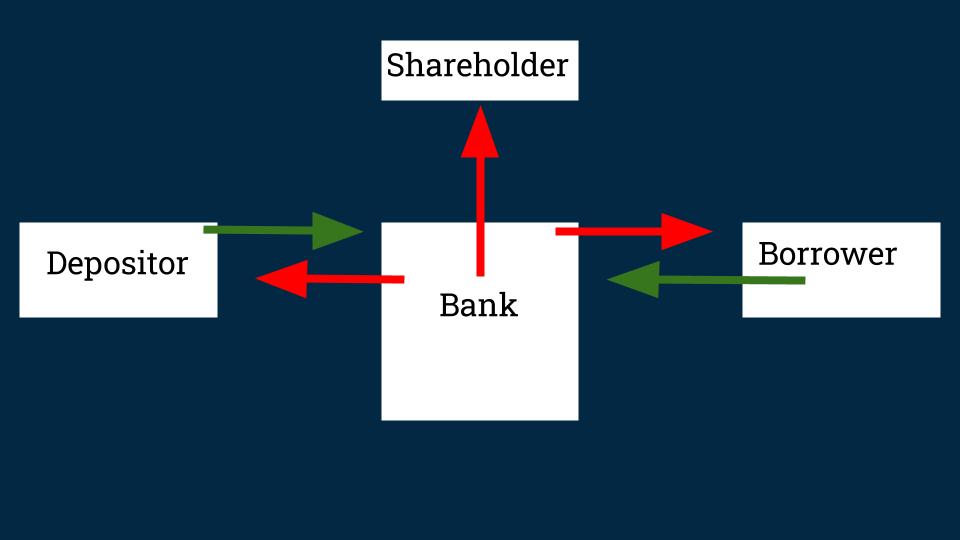

Now that you know the advantages of using a whole life insurance policy, let’s look at how the banking system works. There are four components or parties to the banking system. The first is the bank itself. The second is the depositors. The third is the borrowers. Finally the fourth is the owners or shareholders of the bank.

In its most basic form a bank makes money by charging people money to use or borrow money. The bank’s product is dollars, but the bank doesn’t make or manufacture its own products. They’re a reseller of other people’s products (money). The bank obtains its inventory from the depositors of the bank. People like you and me. Depending upon what type of account you deposit your money into, the bank is willing to pay you to store your money at their institution. In this example, we’re going to use a savings account. To keep the math simple, we’ll assume the interest rate you’ll receive on that account is 1%. I know, that’s a far-fetched number right now but it makes for easy math. This means if you deposit $100,000 into the bank and leave it there for 1 year, you will receive $1,000 in interest from the bank.

The bank, in turn, is going to take that $100,000 and they’re going to lend it to other people or businesses called borrowers. To make a profit, the bank will charge the borrower a higher interest rate than what they’re going to pay you their depositor. Depending upon the loan type interest rates may range from the low single digits to the mid to upper 20% range. Again, to keep the math in our example simple, let’s assume the bank is making 10% on the money it’s lending out. Looking at the same $100,000 being lent out for 1 year at 10% interest, the bank is going to make $10,000 on the money you deposited.

At a glance, the profit margins of a bank seem reasonable. They charge 10%, they pay 1% leaving them a 9% profit margin to run the bank. Looking a little closer reveals the true power of banking. First, let’s look at the dollar amounts. The bank made $10,000 from the borrowers. They paid you the depositor $1,000. This leaves the bank a $9,000 gain. Once we take their investment out of the $9,000 gain they are left with a profit of……..? Wait for a second, they did not have anything invested in the transaction, it was your money they lent out. HOLY CRAP! Since it was your money they lent out, that entire $9,000 gain is profit giving the bank a 900% gain. This is why banking is such a profitable business.

Do you feel a little bit jipped by the banks? Well, you still do not have the full story. Have you ever heard of fractional reserve banking? An in-depth discussion is a blog post for another day but here are the cliff notes. Fractional Reserve Banking is the ability a bank has to lend more money out to borrowers than they have on deposit from depositors. The liquidity ratio is different for different size banks but to keep things simple we’re going to look at 10%. This means a bank must only have 10% of the money they have lent out on deposit.

Given our example above, what kind of money are they making off you now? The beginning of the transaction stays the same. You deposit $100,000, leave it in the bank for 1 year at 1% interest and you receive $1,000 in interest income. Now the transaction changes as the bank has taken your $100,000 and not lent out just $100,000 but due to fractional reserve banking is able to lend out $1,000,000.

Charging 10% interest on $1,000,000 worth of loans now gives the bank a profit of $100,000. So, the bank has made $100,000 off of your $100,000 deposit; hmmm………what’s that profit margin? Let’s see, $100,000 minus $1,000 leaves a profit of $99,000 or a 9,900% return. HOLY CRAP their profits multiplied by 10!

No worries, you reap the rewards of all those profits, right? Since it was your money that provided the inventory to the bank. Unfortunately, no, this is where the fourth piece of the puzzle comes into place. All the profits the banks make are go to their shareholders just like any other corporation (as it should be). So, unless you own shares of the bank, you aren’t going to see any of those profits.

Banking with Whole Life Insurance

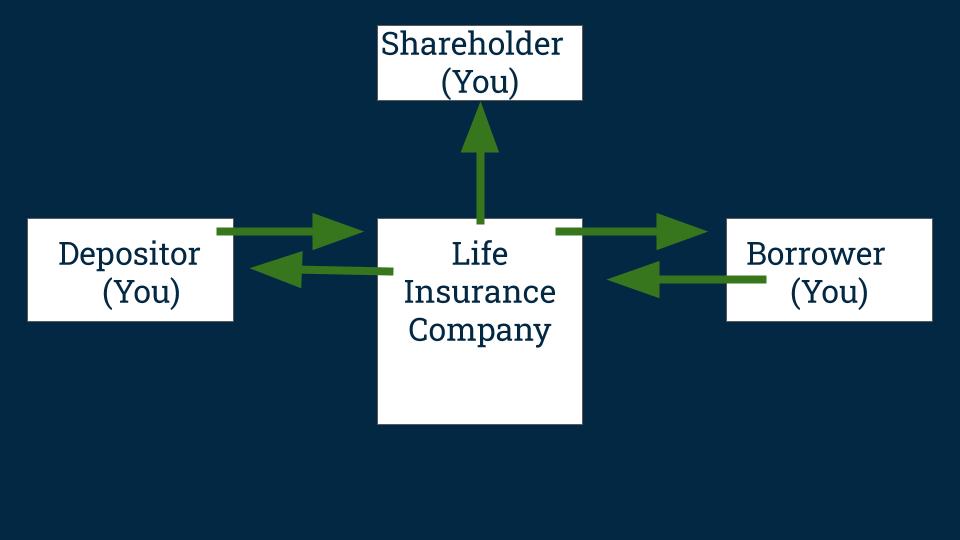

You may not own the bank but you can use the Infinite Banking Concept® to apply the same principles into your personal and business life. Here is how. Take the banking structure, change some of the players and insert yourself into the mix. This creates a personal economic system that allows you to become your own bank, build wealth and achieve economic independence.

First, instead of the bank, we’re going to use a mutual life insurance company. You cannot use any life insurance company out there. It must be a mutual life insurance company. It must also be one that allows an agent to structure a high cash value policy.

Second, you’re still going to sit in the depositor seat. Except for making deposits into a savings account, you’re going to make premium payments into a whole life insurance policy. Word of caution here. Some people will tell you a universal life insurance policy works the same way, they don’t. This is because of the way they are structured; a discussion for another day. On the surface they seem attractive but don’t fall for it. There is a reason the class action lawsuits have started to go after universal life policies. Make sure you have a whole life insurance policy.

Third, one of the ways life insurance companies make money is by lending money from the general funds of the insurance company. If you own a policy that has cash value, you’re entitled to first rights or refusal of obtaining a loan. These loans are a win/win. You win because the loan is easy to get with extreme payback flexibility. The insurance company wins because the loan is fully collateralized with very little risk.

Fourth we have the shareholders of the insurance company, which is also you. The only way to become a shareholder in a mutual life insurance company is to own a policy with the company. Think of it as a co-op, to have ownership you must be a participant. Which means the life insurance company is not beholden to Wall Street. They are not making decisions that are concerned with meeting some unrealistic quarterly earning expectations. This also means they must distribute all their profits. Minus holding enough back in retained earnings to run the business everything goes back to its shareholders. Since you’re a shareholder, bada bing bada boom, you receive some of that moola.

Let’s look at our previous banking transaction and see how it shakes out now. You make premium payments to your policy and have built your cash value up to $100,000. You’re going to earn interest on that money. It will be more than a bank’s interest rate, and to be conservative let’s assume you make 2%. $100,000 over a 1-year time frame means you received $2,000 in interest.

Now, you’re also going to take a loan against your cash value to buy an investment. The insurance company is in the business of making a profit, so the loan isn’t free. They’re going to charge you an interest rate. This rate will depend on which mutual insurance company you’re with. As of the time of this writing, a common rate is just below 5%, so let’s assume you’re being charged 5%. Over the same 1 year, you’ll pay $5,000 interest on a $100,000 loan (assuming you took a loan for your entire cash value).

Since the mutual life insurance company has done a good job, at the end of the year they’re going to distribute a dividend. Let’s assume its 1%. Because you have $100,000 in cash value, you’ll receive another $1,000 in a dividend.

By implementing your own banking system. You have inserted yourself into almost every aspect of the banking transaction. You’re the depositor because you’re making your premium payments. You’re the borrower because you’ve leveraged your cash value. You’re also the shareholder because your policy is with a mutual life insurance company. Your money is now in a system that allows it to more efficiently work for you. Not to include the other benefits of owning whole life insurance.

Using Cash vs a Policy Loan

It doesn’t take a genius to realize creating your own banking system is a better scenario than using a bank. Although, you may be asking yourself how this a more efficient system than using cash? In the above scenario. If we combine your interest with your dividend your policy grew by $3,000 that year and you paid $5,000 in interest. So, it still costs you $2,000 to use your own banking system, right? Not exactly.

Let’s look at the math to see what we come up with. Before we do that, let me state that this concept only works if you’re an honest banker with yourself. If you lack discipline and are willing to rob from your own banking system, then let’s be honest, this won’t work for you.

Back to the math. If you played out a cash scenario and took $100,000 from your savings account and used it to buy an investment. Then over the next 5 years made 60 equal payments to replenish your $100,000 and earned a 5% rate of return. At the end of 5 years, you’d have $113,816 back in our savings account. None of this includes taking inflation or opportunity costs into account. Again just keeping it simple.

Utilizing the Infinite Banking Concept® you have a few more components to consider but some simple math gives us the information we need. First, your $100,000 in cash value is going to continue to grow even if we have a policy loan against it. Looking at a 5-year period of time. If your cash value grows at only 3% (2% less than your savings account was giving you), your cash value will be worth $115,927 in 5 years.

Since you’ve taken a policy loan, you’re paying interest on that loan. At a rate of 5% means at the end of 5 years you will have paid back a total of $113,227 in principle and interest. Since your cash value is $115,927 and you paid back $113,227 you are net positive in the transaction $2,700.

If you now compare your cash value vs the savings account you replenished, you come out ahead $2,111. Using a policy loan rather than cash is the clear winner.

There is a simple explanation of why this arbitrage happens and it’s this. The cash value in your policy is growing at a compounded interest rate. You’re paying the loan back at a simple interest rate. This creates a cash difference in your favor. This is the power of becoming more efficient with your money.

Also, if you’re truly an honest banker (which you should be) you will charge yourself a little extra interest on any loan you take. This will allow you to grow your banking system larger and larger, providing for greater opportunities in the future.

Looking to the future

We’ve looked at one example using the Infinite Banking Concept®. Now consider if you use this system many times over many years. Moving from smaller life purchases to larger investment opportunities will increase the economic value of your life and business.

Doing things differently is how the wealthy get wealthier. The secret sauce for implementing this system is simple. First, set up your first whole life insurance policy properly. Second, use it over and over by funneling as much of your savings through your banking system as much as you can. Third, rinse and repeat.